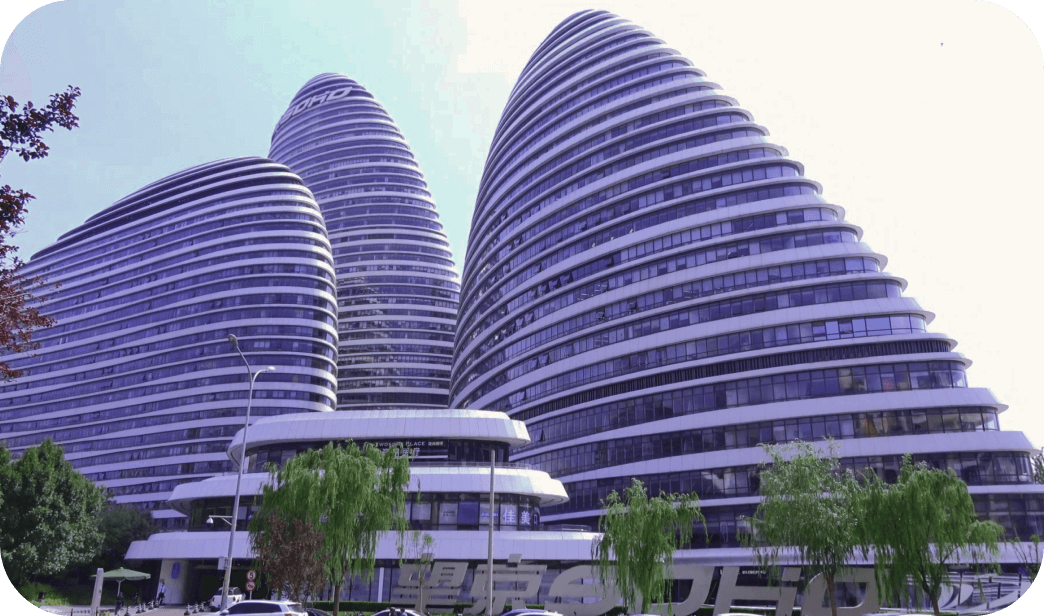

Advanced architecture

Based on the Spring Boot/Cloud framework, it builds a distributed unified payment and clearing platform suitable for cloud + offline, and ADAPTS to the information and innovation ecology.

Product specifications

Provides unified standardized access, unified reconciliation and settlement processing, unified risk management, and unified parameter configuration management.

Practical experience

Successfully running on multiple large financial business systems with transaction volumes of tens of millions. Fully validate reliability, flexibility, stability, and elastic scalability.

Continuous innovation

Focusing on the continuous research and development, optimization and innovation of financial technology platforms for many years, keeping up with the pace of market development.

HOW IT WORKS

Mr.Bank makes the Centralized Online Real-time Exchange come true

Unify

Unify all payment types into a single

payments ecosystem

Deploy

Quickly and automatically deploy

applications in batch to server cluster.

Integrate

Easily connect to cooperative banks,third-

party payment providers,and Fin Techs.

Manage

Define and change workflows and business

rules.

Monitor

Support unified monitoring of cross

platform terminals.

Innovate

Bring new payments products onboard

quickly.

Convenience

Digital payment services offer unparalleled convenience, allowing users to initiate transactions from anywhere and at any time using online banking platforms or mobile apps.

Speed

Digital payments are processed swiftly, enabling near-instantaneous fund transfers and transactions. This facilitates faster settlement of payments, reduces processing time, and improves overall cash flow management for businesses.

BENEFITS

Cost Savings

Digital payments can be more cost-effective compared to traditional payment methods. Businesses can save on expenses related to cash handling, check printing, and physical infrastructure for payment processing.

Enhanced Record-

Keeping

Digital payment systems provide accurate and detailed transaction records. This enables businesses to maintain comprehensive financial records, simplifying accounting and facilitating easy auditing.

Increased Sales

Opportunities

Digital payment acceptance allows businesses to cater to a broader customer base. By offering multiple digital payment options, businesses can attract customers who prefer the convenience and security of electronic transactions.